How Inflation Impacts Retirement and Ways to Combat It

Inflation is often called the "silent retirement killer" for good reason, and it’s been a hot topic in the news over the last two years. Since 2020, inflation rates have been higher than the long-term average, reaching 7.0% in 2021 and peaking at over 9.0% in mid-2022—levels not seen in decades. While these rates have started to moderate, the ripple effects of higher prices continue to impact retirees and those nearing retirement. Understanding how inflation works and how to protect yourself is essential to ensuring your savings last. Here, we’ll explore the impact of inflation on retirement and provide strategies to combat it.

The Impact of Inflation on Retirement

Inflation refers to the gradual increase in prices over time, which reduces the value of money. For retirees on fixed incomes or with limited earning potential, inflation poses a unique challenge:

Reduced Purchasing Power: Even a modest inflation rate of 2-3% annually can erode your purchasing power over the years. For example, something that costs $50,000 today could cost over $67,000 in 15 years with 2% inflation.

Rising Healthcare Costs: Healthcare inflation tends to outpace general inflation, with annual increases often exceeding 5%. For retirees, this means higher medical expenses over time.

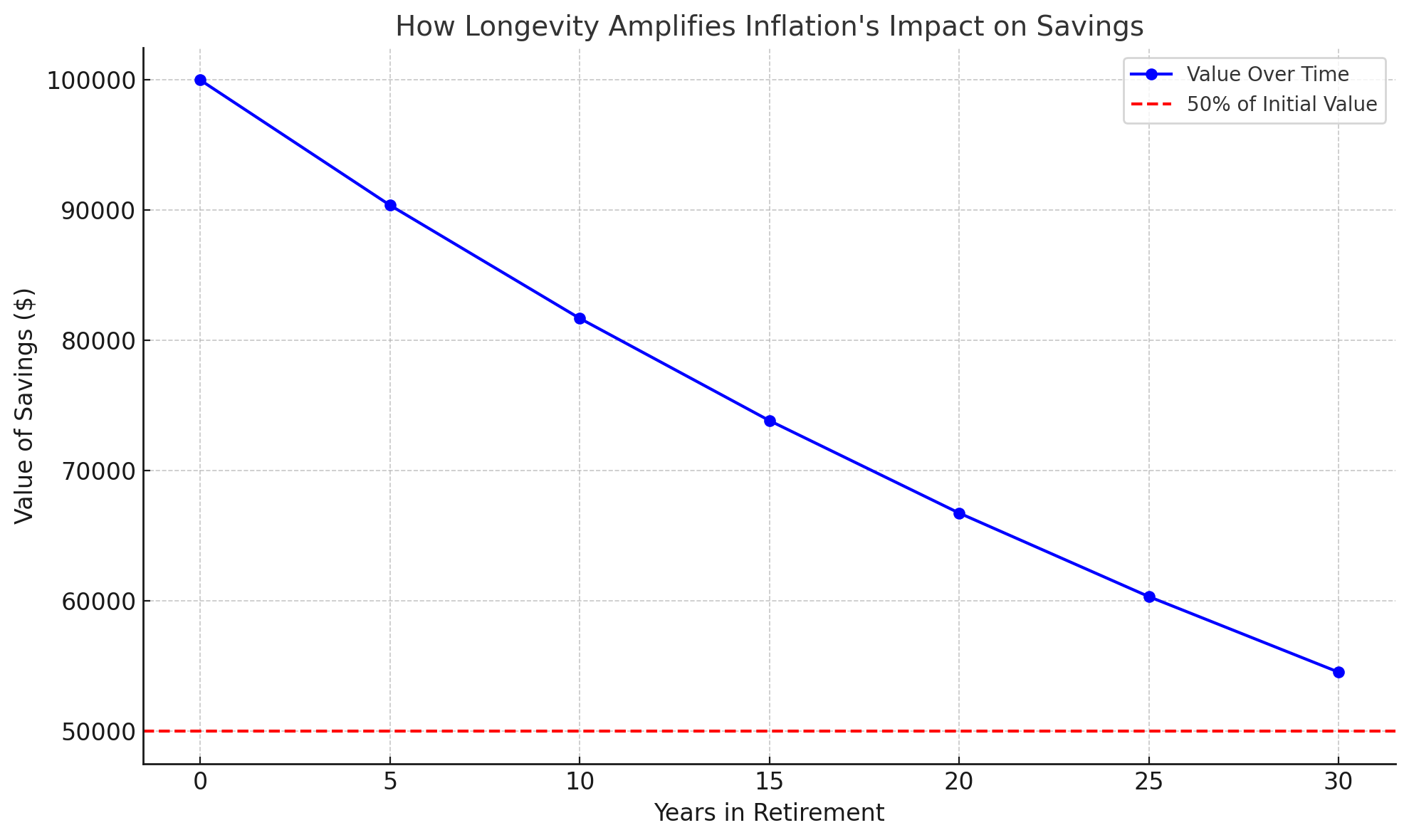

Longevity Amplifies Inflation: The longer you live, the more inflation impacts your savings. A 30-year retirement can see the value of money diminish by more than half if inflation averages just 2% annually.

Strategies to Combat Inflation in Retirement

Invest for Growth Keeping all your money in low-risk, fixed-income investments may feel safe, but it exposes you to inflation risk. A balanced portfolio that includes growth-oriented assets like equities can help outpace inflation and preserve purchasing power over the long term.

Diversify with Inflation-Protected Securities Consider including Treasury Inflation-Protected Securities (TIPS) or other inflation-linked investments in your portfolio. These securities are designed to adjust with inflation, providing a safeguard for your savings.

Delay Social Security Benefits Social Security benefits are adjusted annually for inflation through cost-of-living adjustments (COLAs). Delaying benefits can increase your monthly payments significantly, providing a larger inflation-adjusted income stream.

Plan for Healthcare Costs Proactively addressing healthcare inflation is critical. Invest in supplemental insurance or a health savings account (HSA) if eligible, and factor rising medical expenses into your retirement budget.

Create a Retirement Income Strategy Structured withdrawal strategies, such as the "bucket approach," can help manage inflation risk. For example:

Keep short-term expenses in cash or fixed-income investments.

Invest medium- and long-term funds in growth assets to counteract inflation over time.

Consider Annuities with COLA Adjustments Some annuities offer cost-of-living adjustments, providing increasing income over time to help offset inflation. Discuss this option with your retirement planner to see if it’s right for you.

Factor Inflation into Your Budget Regularly review your retirement budget and adjust for inflation. Plan for future price increases in categories like housing, utilities, and leisure activities.

Why Planning for Inflation Matters

Ignoring inflation in your retirement plan can lead to significant financial shortfalls. By proactively addressing its impact, you can:

Maintain your desired lifestyle without compromise.

Preserve the longevity of your savings.

Reduce stress and uncertainty about future expenses.

Final Thoughts

Inflation is a challenge every retiree must contend with, but with the right strategies, it doesn’t have to derail your financial future. Working with a retirement planner ensures that your investments, income streams, and spending plan are structured to combat inflation effectively. Contact us today for a no-cost, no-obligation consultation to build a retirement strategy that protects your purchasing power and keeps you financially secure for years to come.